On May 14, AWS announced Adam Selipsky’s departure as CEO and that Matt Garman, AWS senior VP of sales and marketing, would replace him in June. Selipsky’s reasoning for this move was to “spend more time with family for a while, recharge a bit, and create some mental free space to reflect and consider the possibilities.” Whatever the reasons for his departure, Selipsky’s exit comes at a time when AWS is standing at a strategic crossroads.

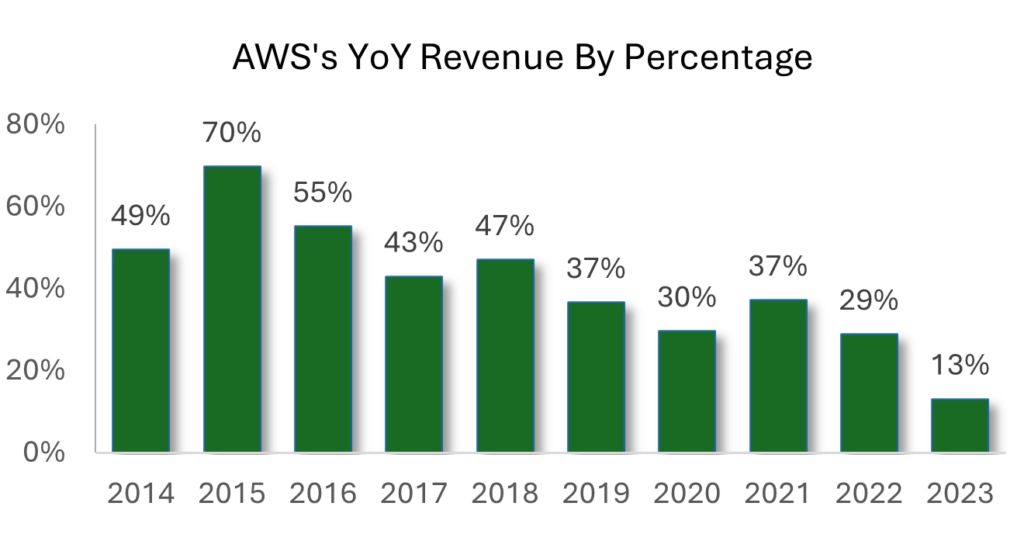

AWS has seen slower year-on-year revenue growth under Selipsky’s tenure. The generative AI moment caught AWS flat-footed, placing them third in generative AI offerings among the hyperscalers — unfamiliar territory for AWS. Moreover, AWS lags Azure and Google Cloud in providing Scope 3 greenhouse gas emissions data — data it promised in early 2024 but has yet to deliver.

Still, not all these missteps are specific to AWS. The slower cloud growth isn’t necessarily a Selipsky issue but rather a public cloud market issue. All major cloud providers have seen slowed growth in the past 18 months. A tech recession shifted the frenzied “cloud-first” mentality to a “cloud-as-necessary” mindset. The result: slower cloud spending compared to the hyper growth of the previous five years. It’s also a sign of maturity in cloud usage, particularly among North American and European customers.

Cloud growth will eventually slow as adoption continues and there are fewer areas to conquer. Newer areas of growth are at the edge, along with higher-margin service further up the stack, with data and analytics services increasingly tied to AI. Yet to compete, hyperscalers must continue to make enormous investments in both look-alike compute, storage, and network services as well as pricey and scarce GPUs from NVIDIA, all while developing their own custom silicon for AI. Plus, questions remain around AWS’s partner strategy as enterprise customers embrace multicloud and lean on global systems integrators to deliver platforms and solutions. All this adds new uncertainty over who will be the kingpin of cloud in the long run.

AWS Remains At The Top With Cloud, But An AI Reckoning Looms

AWS is still the market share leader by a long way, yet the Microsoft/OpenAI combination opens the door for Azure to bring AI services to market. Copilot and its slew of AI-infused services places Azure in a potential leadership position with AI — a notable feat, especially as Microsoft has spent many years catching up to AWS via enterprise cloud services and offerings. Similarly, Google Cloud’s steady advance in the enterprise market — in part due to its data, analytics, and AI capabilities — adds to the competitive pressure. Then there’s the central role that AWS plays in Amazon’s bottom line. In many quarters, it’s AWS’s revenue that puts Amazon overall into the black. This makes AWS strategy inseparable from the broader Amazon one as cloud revenue underwrites Amazon’s ever-expanding market reach. So far, AWS hasn’t signaled any shift in its approach — but the internal debate of how to move forward likely figured into Selipsky’s exit.

About a year ago, Selipsky said that “there is no AI without the cloud.” In the future, however, Forrester believes that there will be no cloud without AI. Intelligence has become one critical element in the future of cloud. Our latest research on public cloud platforms for Europe and China, as well as in other forthcoming reports, discusses the growing variety of use cases with AI everywhere.

All this poses a strategic question for AWS: Does it mimic Microsoft’s approach by moving up the technology stack or stick with the “go build it” approach that’s been so successful? There’s an argument for staying the course. AWS has grabbed its market share lead through constant innovation and its dictum of “working backwards from the customer.” Given the enormous data gravity that many of its customers have with AWS, a large number will continue to use AWS custom AI silicon rather than wait around for NVIDIA availability. They’ll try the Bedrock managed AI services and the Q chatbot to tap genAI capabilities, while Q is breathing new life into offerings such as QuickSight for business intelligence.

What Now For AWS?

AWS’s differentiation historically has been in infrastructure. Rather than compete in areas like enterprise software suites, it can double down on custom silicon GPUs as an NVIDIA alternative. AWS could bring its “go build it” cloud strategy to genAI to help customers home in on use cases that matter most rather than pushing AI everywhere. Still, this approach risks ceding ground to Azure as Microsoft courts business users by embedding AI into souped-up versions of Microsoft 365 and Dynamics while rolling out OpenAI-based services more generally. Google Cloud, which climbed into many enterprise accounts as a second or third cloud focused on data, has its own powerful AI offerings as well as general-purpose cloud capabilities. Oracle Cloud Infrastructure is now in the mix for enterprise cloud customers, putting pressure on AWS and others with its low egress charges and overall price competition, as well as its premium database services and growing AI offerings. Red Hat continues to have a strong play in multicloud and hybrid environments.

The responsibility for responding to these challenges now falls on Matt Garman. Where he comes down on these strategic decisions will shape AWS — and its customers — for years to come.