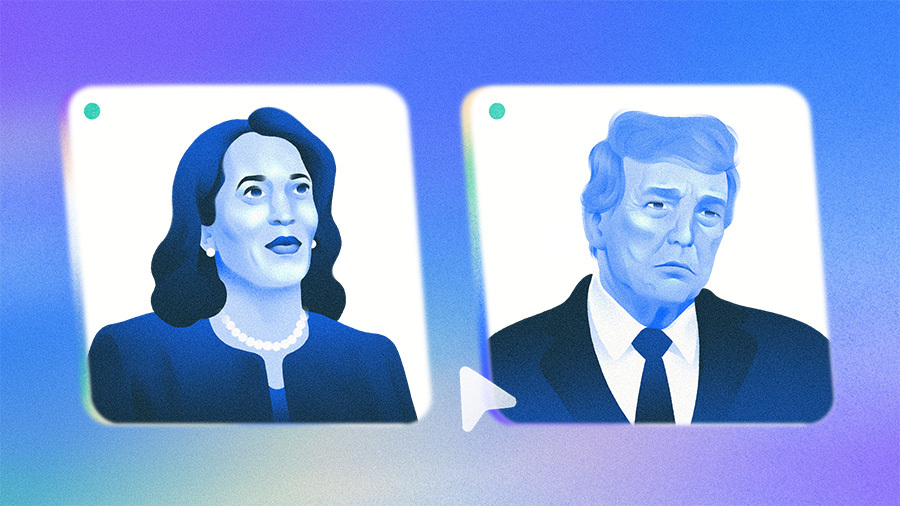

Just like most of America, those in the venture and startup realm will watch the returns of the U.S. presidential election pour in next week with a keen eye on who wins — and what it could mean for big issues in the industry such as M&A, taxes and even crypto.

While the next American president will not solely decide those issues, who is elected likely will have a large say in regulations and tax changes that could have significance on industries ranging from AI to biopharma and from the biggest of Big Tech to a pre-seed startup.

Let’s take a look at some of the biggest issues VCs and founders likely are watching as the presidential election looms only days away.

Antitrust

By far the main issue most investors — and even startups — are curious about is what the next president could mean for the very tepid M&A market.

“This is really big issues one, two and three,” said John Stanford, executive director of Incubate, a Washington, D.C.-based coalition of life sciences investors. “We have to rein in this (regulatory) environment.”

Amazon‘s proposed $1.4 billion acquisition of iRobot is one example of a scrapped deal thanks to what some investors think is an overzealous regulatory environment for M&A that they blame on the Federal Trade Commission and U.S. Department of Justice.

Venture investors need exits for their companies in order to continue to invest. “In venture, the winners pay for the losers,” Stanford said. “So you need those winning deals.”

But M&A dealmaking involving VC-backed startups has slowed through the past few years, Crunchbase data shows.

While big deals that get tied up in reviews make the headlines, other smaller under-the-radar deals have failed to materialize because they have become more expensive and deemed not worth the money and hassle, Stanford said.

What will happen with regulation after the election is unclear. While former President Donald Trump has promised less regulation and to exert more presidential authority over the FTC, he has at times both supported some moves by tech’s biggest players and been critical of the power they hold. Running mate JD Vance, however, has praised the FTC in the past for reigning in Big Tech.

And while many expect the same regulatory atmosphere to continue if Vice President Kamala Harris becomes president, being from Northern California she also has close ties to and friends in Silicon Valley and could listen to their concerns about regulatory agencies.

Nevertheless, VCs say they are hurting for liquidity as the IPO pipeline remains pretty frozen and the M&A market is weak.

Crypto

Perhaps the most talked about of all startup industries during the election run-up was crypto.

The crypto community — which includes many startups and venture investors — has been at odds with the federal government as to what asset class crypto should be considered. That brings up the question, therefore, about which government agency should oversee it, the SEC or the Commodity Futures Trading Commission.

Crypto proponents have also been aggressive in 2024. Nearly half of all corporate money contributed to this year’s federal election campaigns has come from crypto backers, according to a recent report from the advocacy group Public Citizen. In total, crypto corporations and wealthy investors have donated more than $119 million directly into the 2024 federal elections.

While Trump has clearly been wooing the crypto crowd (he has his own crypto project), Harris’ campaign has made no big edicts on crypto. However, the Biden administration has been viewed as unfriendly to crypto — especially SEC Chairman Gary Gensler, who has taken a strict regulation-by-enforcement approach to crypto.

“While we don’t really know what Harris thinks of crypto, she is courting the community,” said Bradley Tusk, CEO and co-founder of Tusk Venture Partners, a venture firm that invests in highly regulated markets.

Just last week it was reported that Chris Larsen, co-founder and chairman of digital payment network Ripple, has given more than $11.8 million to PACs supporting the Harris campaign.

“I think most in crypto just want to know who will replace Gensler,” Tusk said.

Taxes, biotech and more

While antitrust regulation and crypto have dominated the election news in the startup and venture world, there are more issues at play.

Stanford said many VCs are hoping the election winner will renew the provision from the Tax Cuts and Jobs Act of 2017 that gave immediate tax deductions for research and development expenditures that have expired — something that can greatly affect startups that often spend a decade or more just developing a product.

There also are concerns around healthcare provisions in the recent Inflation Reduction Act that capped drug prices and what those could mean for biotech/biopharma investment moving forward, Stanford said.

“There could be a smaller reward for small molecule medicines investment down the road,” he said.

Tusk said he is looking for the federal government to finally give guidance on interstate transportation regarding autonomous driving — something the current administration has not done.

In the macro picture, Tusk added the venture world also should be watching Trump’s promise of eliminating the independence of the Federal Reserve — something that would have a significant effect on the economy as a whole.

In the end

No matter the outcome, the presidential election is likely to only be a piece of the much larger pie that will affect venture and startups.

With the House and Senate margins likely to remain razor thin, it probably will still be hard for large initiatives to be pushed through.

Tusk, whose firm specializes in regulated industries, said it also is extremely important to remember that most tech regulation is not put in place by the federal government.

“The vast amount of tech regulation happens at the municipality and state level,” he said. “It doesn’t happen at the federal level. Really, things such as governors matter more when it comes to those types of regulations.”

And while folks like to focus on their specific issue or cause and where a candidate may stand, Stanford said most people in venture want the same thing. “As businesses scale, the best thing is usually for government to stay out of the way,” he said. “Most investments are going to fail anyway. We don’t want more interference and uncertainty from the government to make the job even harder.”

Related Crunchbase Pro lists:

Related reading:

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

1 month ago

17

1 month ago

17