How risk managers can navigate the storm through collaboration with IT departments.

In the ever-shifting landscape of financial markets that makes managing risk a pressing challenge, banks are facing significant turbulence.

Macroeconomic trends are unfolding under a backdrop of geopolitical conflict. Firms are facing higher funding costs and softening demand due to rising interest rates. Labor trends and supply chains are unpredictable. Central banks around the world do their best to battle stubborn inflation. Headlines have been littered with the names of failed banks that struggled to manage these pressures. With market volatility reaching new heights, how are risk managers steadying the ship?

This blog explores how vertically integrated risk management solutions that use AI and automation enable unparalleled visibility, control, and efficiency for risk management in banking. The result: financial services organizations that are more resilient and able to weather the storm of today’s uncertain economy.

The fundamentals of banking risk management

To preserve earnings and bolster balance sheets, banking risk management functions must do the following four things well:

- Synthesize a broad range of volatile market-driven signals into actionable insights.

- Surface and make decisions on those insights in as near real-time as possible to drive favorable outcomes.

- Deploy risk-based estimates and models with confidence, accuracy, transparency, and speed.

- Optimize the IT infrastructure supporting risk management processes and controls for maximum performance and resilience.

Dynatrace offer banks turnkey technical capabilities to execute these objectives effectively and efficiently. This enables

Risk in banking is broad and interconnected. Managing these risks involves using a range of technology solutions, from in-house, do-it-yourself solutions to third-party, software-as-a-service (SaaS) solutions.

Mission-critical risks in banking

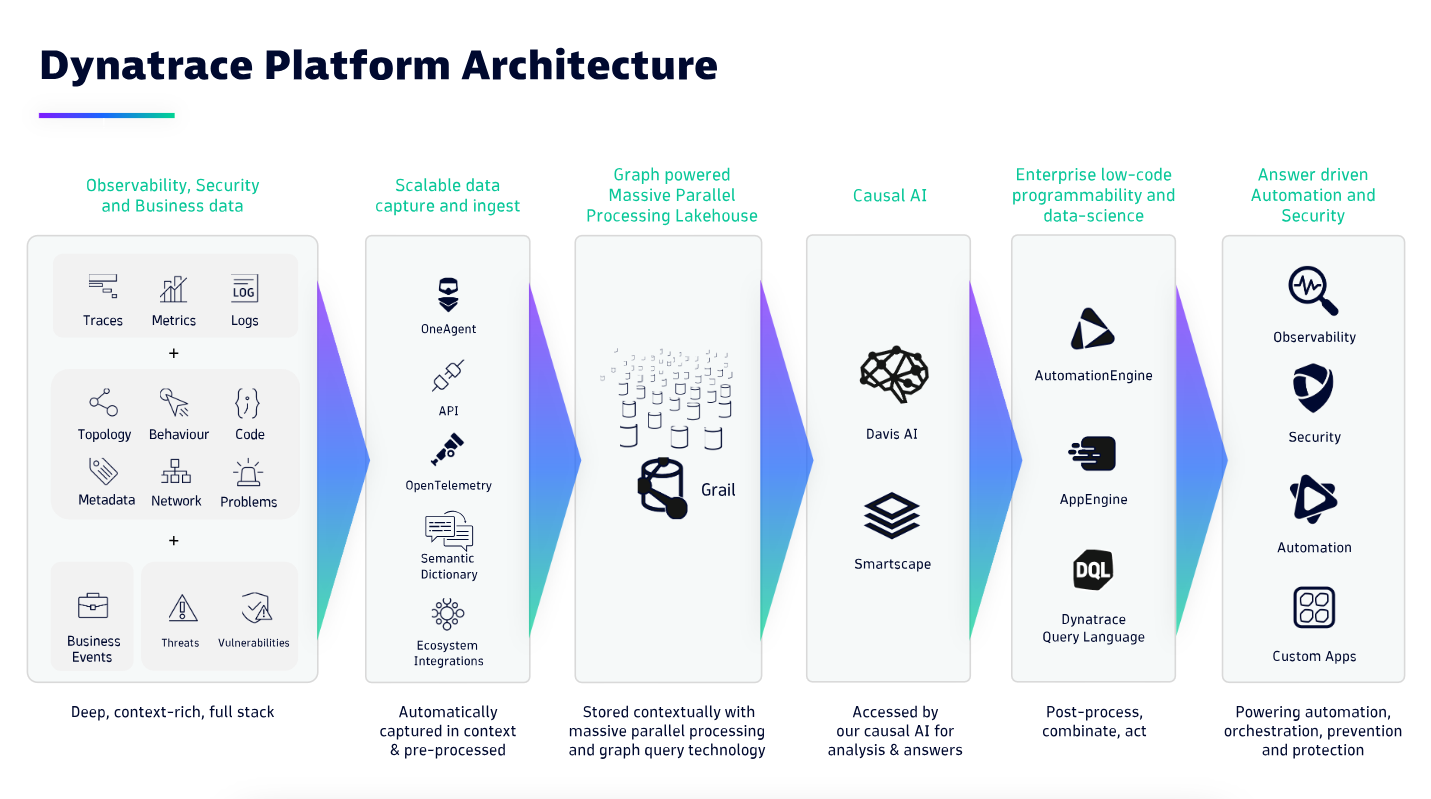

Dynatrace brings a flexible, easy-to-implement, and vertically integrated technology solution to risk management for banks.

The IT infrastructure, services, and applications that enable processes for risk management must perform optimally. If system failures occur, teams must resolve them quickly and resolutely. Dynatrace’s best-in-class observability solution offers peace of mind to IT leaders and risk leaders, that the technology supporting risk management functions in banks is resilient and performing optimally.

Once teams solidify infrastructure and application performance, security is the subsequent priority. Dynatrace’s application security solution fills a major gap in banks’ security apparatus: at the application layer. The Dynatrace platform allows security teams to automate continuous discovery, proactively detect anomalies, and optimize across the software lifecycle. This multipronged approach enables banks to release higher-quality and more secure software, faster.

Maximizing a strong foundation of IT infrastructure performance and security means effectively utilizing all the data that these systems produce to drive risk management processes and decision-making. Dynatrace Grail harnesses all this data into an efficient, flexible, powerful, low-maintenance data lakehouse that enables IT leaders and risk managers to get the data they need, in real-time and aggregated in the desired context. Grail drives insights and decisions that preserve earnings and strengthen balance sheets.

In summary, the Dynatrace platform enables banks to do the following:

- Capture any data type: logs, metrics, traces, topology, behavior, code, metadata, network, security, web, and real-user monitoring data, and business events.

- Collect data automatically and pre-processed from a range of sources: application programming interfaces, integrations, agents, and OpenTelemetry.

- Produce a broad range of actionable outputs: custom applications, workflow automation, business process monitoring, notebooks, and dashboards.

Power business analytics with Dynatrace

Banks that can deploy vertically integrated risk management solutions will deliver unprecedented agility, precision, and control for risk management functions. They can accomplish this all while delivering transformation efficiency and economies of scale for IT functions that maintain risk management infrastructure.

Historically, IT infrastructure performance, IT security, data architecture, and data analytics, have been managed in disparate, unconnected silos deep within IT organizational structures. Even further removed are the risk managers and operators that depend on this infrastructure to manage capital and liquidity risk, credit risk, investment and market risk, estimation and model risk, regulatory risk, and fraud. Disjointed teams, goals, objectives, and tools often translate to wasted time, money, and redundancy.

Conversely, harmonizing mission-critical work streams and adjacent technologies often results in exponential value creation and economies of scale. The Dynatrace platform enables organizations to harmonize risk management technology infrastructure, data, analytics, and processes to produce exponential value and economies of scale.

Risk functions realize unprecedented visibility and control through the following:

- Automated aggregation of data from disparate sources.

- Automated delivery of actionable insights in real-time and in context.

- Automated risk management workflows, processes, and decisions.

- Resilient, high-performing technology ecosystems that accelerate innovation through faster development cycles.

IT teams that support risk functions realize transformational efficiency and economies of scale through the following:

- Automated IT performance optimization.

- Automated issue resolution.

- Synergies from the consolidation of multiple essential IT tools into a unified platform: observability, application security, log management, data storage, and data analytics all in one.

The ease of implementation and the flexibility of the Dynatrace platform enable banks to start realizing the benefits of a vertically integrated risk management solution, no matter where that bank is today from an IT infrastructure or organizational perspective. Dynatrace easily integrates into the existing IT environments of today and is purpose-built to scale for tomorrow.

Cross-functional collaboration is crucial

Realizing the benefits of a vertically integrated risk management solution will require a new level of collaboration between risk management and IT functions.

IT teams understand technology infrastructure and what various components of that infrastructure are capable of. However, they generally do not know what the outputs of that infrastructure are and how those outputs are used to manage risk.

Risk managers and operators understand the risks to the business. They also know what information and types of processes are necessary to manage those risks within institutional guardrails. However, risk managers are generally unaware of how technology has evolved to enable automated, real-time insights and solutions that were historically not feasible or cost-effective.

The immense benefits of a vertically integrated risk management solution become clear for financial services institutions. But, achieving organizational alignment to scope the solution, build a comprehensive business case around it, and implement it is a different matter entirely. This is why cross-functional collaboration, centered around technology-enabled business value creation, is an essential component of banks’ evolution into modern risk management solutions.

Managing risk with a unified platform

Dynatrace’s unified platform can bring these perspectives together, making technology infrastructure a force multiplier in risk management effectiveness and efficiency. Dynatrace helps customers quantify the value of these benefits to make them clear and digestible for organizations responsible for investing in and implementing modern risk management solutions.

The following are several use cases where vertically integrated risk management solutions can be applied to deliver value:

- Build a centralized risk operations center that delivers complete visibility of firmwide risks. Risks include capital, liquidity, market risk, credit risk, security risks, operational risks, and fraud.

- Get full visibility and automated optimization of trading processes across asset classes.

- Automate stress-testing and regulatory reporting requirements.

- Maximize performance for high-frequency and low-latency trading strategies.

- Institutionalize processes for technical stress testing and technical audits of trading systems.

- Break down data silos. Combine traditional fraud detection techniques with data science and analytics to combat financial crime more effectively.

- Strengthen application security with a multipronged approach.

- Monitor and neutralize insider threats from negligent or malicious employees and contractors.

Connect with Dynatrace to understand how a vertically integrated risk management solution can leverage AI and automation to make your bank more resilient today.

For more on Dynatrace and the financial services industry, check out our ebook here.

10 months ago

60

10 months ago

60