Source: thinkhubstudio via Shutterstock

Though funding for cybersecurity startups began slowing globally in late 2022, Israeli startups continue to win significant cybersecurity investments, even with the nation's ongoing military operation in Gaza and escalating regional tensions.

The continued investment shows that Israel continues to be one of the strongest hubs for tech innovation in the US outside of Silicon Valley, says Or Shoshani, CEO and co-founder of Tel Aviv-based Stream.Security. His company, a cloud detection and response firm, garnered its first round of funding — a $26 million Series A — in March 2022 at the tail end of the boom. Earlier this month, the company was awarded a Series B round for $30 million.

"I've been traveling more than I've been doing in the last four years. Why? Just to show that we are here to support our customers, and we have built a business that is truly resilient, regardless of where we are and regardless of the state [of affairs] Israel is experiencing."

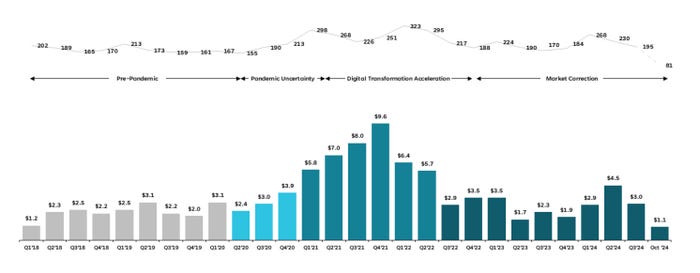

Following a two-year drought, cybersecurity startup companies are seeing an uptick in investment internationally, with the value of deals expected to grow by 45% in 2024 — a reversal of fortunes compared to the 40% decrease in 2022 and 49% drop in 2023, according to data from cybersecurity investment-advisory firm Altitude Cyber.

Related:Microsoft VS Code Undermined in Asian Spy Attack

Following a peak in Q4 2021, investment in cybersecurity firms tapered off for two years. It's starting to return. Top: Number of deals. Bottom: Value of deals in billions of US$. Source: Altitude Cyber

The investment focus of Altitude Cyber's clients, for example, remains the US, Israel, and Europe, followed by the rest of the world, says Dino Boukouris, founder and managing partner at the firm.

"We don't anticipate that trend will change any time soon," he says. "Even with the geopolitical climate we're in, Israel has continued to deliver, the US cyber market remains as strong as ever, and Europe [and the] UK continue to innovate and produce really great cyber companies."

Cybersecurity Springs Back

Israel's research and development centers took off during the US regulatory assault on encryption in the 1990s and the migration of chip design to many of the technology parks around Tel Aviv and Haifa during the past two decades. On the cybersecurity side, the nation has developed "outsized" capabilities, according to a recent history of Israel's evolution in cybersecurity.

Similar to Silicon Valley, going out for a cup of coffee often means running into two or three entrepreneurs that are going to tell you about their latest idea, says Jacques Benkoski, general partner at US Venture Partners, an investor in Stream.Security.

With the country's focus on cybersecurity and the density of talent and education available in a small area, innovation naturally follows, he says.

Related:Under-Resourced Maintainers Pose Risk to Africa's Open Source Push

"When you look at the history of venture capital, you have nodes of innovation that are characterized by a catalytic density of talent — you look at places like Silicon Valley, you look at places like Tel Aviv, and you just have a lot of people that are focused on the same thing," he says. "And from the acceleration through dialogues and the collisions [of ideas] between those people comes more innovation" than other parts of the world.

Yet, one aspect of Israel's venture-capital scene is that investors do not want to fund companies solving local problems. Instead, the focus is on creating technologies and businesses that address issues in the US, Europe, and worldwide, Benkoski say.

"We typically invest in companies that see the US as their primary market — it's actually an investment condition," he says. Second rounds of venture capital for companies like Stream.Security are often to develop a stronger presence in their primary market, he adds.

Broadening Out Cybersecurity Investment

While the country's cybersecurity ecosystem certainly has its adherents, other investors see a focus on local ecosystems to be desirable. Ukraine has historically had a strong cybersecurity community — albeit mixed with its share of cybercriminal groups — and that could see a resurgence if Russia ends its war, says Ron Gula, president of Gula Tech Adventures, an investment firm.

Related:Software Productivity Tools Hijacked to Deliver Infostealers

"I'm hopeful that the Ukraine war will end soon, and believe the tech ecosystem there will emerge as a rival to the Israeli ecosystem," he says.

Other areas of the world also offer substantial benefits for investment. In addition to expanding its investment into Israel, Forgepoint Capital plans to focus on Latin America and the Asia-Pacific regions, where the mobile-first ecosystem requires a tailored approach to cybersecurity, managing director J. Alberto Yépez says.

"Other geographies have more of a built-in enterprise industry infrastructure to support local innovation, with established institutions taking an active role to drive collaboration and better anticipate and address their customers' needs," he says, adding that the firm has partnered with global financial institutions to help innovate. "We aim to address a critical gap in growth funding for startups in Europe while expanding our purview into Latin America and Israel," he says.

One overhyped technology for investors? AI. While artificial intelligence has technology giants spending heavily — and nearly every cybersecurity firm boasts of AI features — the impact of AI startups on cybersecurity remains modest, says Altitude's Boukouris. But there have been some significant financing deals for AI-cybersecurity companies in past few years, including Protect AI ($60 million in Series B funding, HiddenLayer ($50 million, Series A), Witness AI ($28 million, Series A), and Cranium ($25 million, Series A), he says.

"Vendors specifically focused on security for AI/ML are still primarily in the early stages in terms of funding," he says. "We've only seen one significant M&A event so far, with Robust Intelligence being acquired by Cisco for around $300 million, which indicates that we are still in the early stages of security for AI."

2 months ago

35

2 months ago

35