By John S. Kim

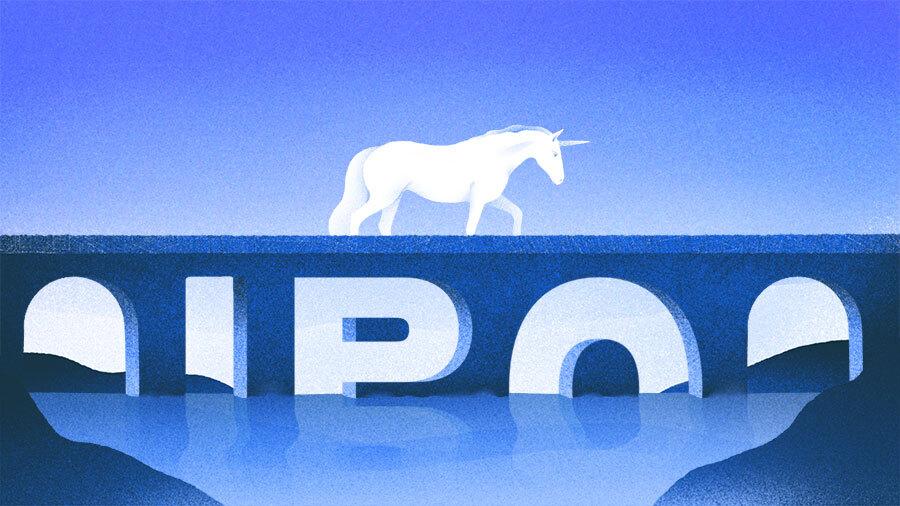

It is now official: After a false alarm in 2021, the Reddit IPO is finally coming. And the market looks far different than it did the last time.

What should we expect both from Reddit and the larger IPO market? After collaborating with Reddit for a number of years (Reddit was one of the earliest customers at my company Sendbird), here’s my take.

The market appetite

Reddit confidentially filed back in 2021, trying to get out the door before big market shifts. It hit at the downswing of a banner year.

John Kim, co-founder and CEO of Sendbird

John Kim, co-founder and CEO of SendbirdThere were a staggering 1,035 IPOs in 2021. Unfortunately, enthusiasm for IPOs dampened on the tail end, courtesy of rising inflation, the ongoing pandemic and the Fed’s forecasting.

There were just 181 IPOs in 2022, which dropped to 154 last year — the fewest since 2016.

Reddit wisely postponed, even as a company with impressive growth and name recognition.

The market looks much more promising in 2024, with inflation on the decline and rumblings of rate cuts on the way.

As first out of the gate, does this mark the beginning of an upswing, sparking a new wave of exits from startups that have been waiting for signs of safety, particularly in terms of communications technologies?

So much has happened since Reddit first thought about its exit. Even as the market collapsed, communications technologies like chat and communities have infiltrated all facets of our lives and business.

Is now its time to capitalize? Or will Reddit fail to perform, making other startups even more gun shy?

What Reddit does well

Where Reddit excels is obviously its strong communities. They are totally authentic, and people feel like they’re having a live conversation with others who share their interests and opinions, even on the most random or mundane of topics. Some subreddits, such as r/AmITheAsshole, have an almost cult-like following, acquiring hundreds of thousands of views as well as garnering mainstream media attention.

According to Reddit’s filing, it averages 73 million daily unique visitors. This is incredible. It signals that even though Reddit has been around for almost 20 years, it is still offering people something they want, even crave. With more than 100,000 active communities, it would appear it has something for everyone.

Reddit cultivates a very organic and human experience, which differentiates it from other social sites. This long-standing commitment to humanity and fostering belonging for all members was apparent during COVID. It gave people something they desperately needed, but whereas other sites that saw DAU numbers spike during the pandemic and fall off a cliff after, Reddit has been largely immune from the mass exodus.

Rather, its numbers are still going up. It’s become a spot where interesting conversations can be had at any time, day or night, and everyone is welcome (as long as they adhere to community standards).

Another area that bodes well for Reddit’s future prospects can be found in its company values. These are all very nice statements, but Reddit has shown time and again that it actually lives by them.

I can say that Reddit was instrumental to our product development and innovation efforts, not just in scaling infrastructure for massive traffic, but especially in the areas of moderation and safety. Together, we’ve pushed existing chat boundaries further than many thought possible.

To its credit, the Reddit team was always highly collaborative, working alongside us to build new features with the needs of communities always at the forefront. From the very beginning of our partnership, the Reddit team emphasized how important it was to get the user experience right for large, community-based chat rooms; they came to us because they wanted to spend time making it the best it could versus allocating that time to building out the nuts and bolts of the technology in-house. As such, they embraced the API economy — not just with us but with other organizations — to consistently deliver the highest quality experience to their users in the shortest possible time frame.

Another example of putting community first is the decision to reserve shares for 75,000 users. That could be quite the payback for those who invested so much in helping the community thrive. It’s this kind of out-of-the-box thinking that sets Reddit apart.

Reddit’s question marks

But Reddit is not without its challenges. Even as revenue increases, it’s still not cash-flow positive. This is something that may give investors pause, particularly given how long Reddit has been around. It could also limit its valuation.

More interestingly though, I wonder about Reddit’s deal with Google to share its data. The numbers involved help erase investor doubts — and probably make many quite giddy about the new revenue stream.

It is a deal that will also help advance generative AI in potentially exciting ways, and it could make similar deals with other AI providers. But it also gives me pause. How does the community that makes Reddit so special feel about giving third parties the ability to “license access to search, analyze, and display historical and real-time data from our platform?”

Reddit is a place where many convey their deepest, darkest thoughts. Even if anonymized, it feels a little creepy giving Google access to such confessions. Will it be a turn-off to community members? Does it change the discourse?

Where Reddit should focus

Once Reddit becomes a public company it will have to give up some control, as all public companies do. Answering to shareholders is inevitable. As such, there are some areas that could present challenges:

- Growth: The biggest question that Reddit will have to answer to shareholders will be how the company can continue growing and retaining its massive user base. For example, when there were calls to make its interface more intuitive and welcoming to new users for the sake of growth, those calls were met by some resistance from existing users who don’t want Reddit to relinquish its quirky charm. That’s a difficult line to walk. But Reddit’s magic is in its ability to generate engagement and lively interaction among members on any topic under the sun. If shareholders want to hang on to and continue to grow Reddit’s user base, the platform can’t deviate too far from who it is.

- Competition: Every app is becoming more social, and emerging apps from all over the world would love to steal Reddit’s fanatical user base (especially during an election year). How many of those apps can boast that their users don’t just start conversations but start movements? Reddit is a huge horizontal platform, and small vertical equivalents for gaming, finance, fitness, you name it, will look to cut into its market share. If Reddit stays true to its mission, continues focusing on making something people love, and maintaining its standard for a quality, inclusive experience, it is hard to see users turning their back on something that has become such a vital part of their daily lives. But, as the saying goes, only the paranoid survive.

- Monetization: Reddit operates primarily under an ad-based model, but there has been a shift away from these models. Substack is a great example of this. As with the Google deal, Reddit may want to consider expanding its monetization offerings moving forward. Monetization is a tricky question, particularly as a public company, because you have to please your users, but still have to be accountable for financial metrics. It will be interesting to watch Reddit tread these waters.

There you have it, friends. This is one of the most exciting IPOs for 2024 and I know I’ll be watching keenly. I trust many of you will be as well.

John S. Kim is the co-founder and CEO of Sendbird, a communications platform for web and mobile apps. He is also the general partner at Valon Capital, an early-stage venture capital firm focused on B2B, SaaS, AI and deep tech. Earlier in his career, he started Paprika Lab, a social gaming company, which was acquired by Gree.

Related reading:

- Reddit Moves Forward With March IPO Plans, Report Says

- Forecast: As IPO Market Ends 2023 With A Whimper Not A Bang, What Does 2024 Hold?

- Forecast: 15 Companies We Think May Actually, Really, Finally, Maybe Go Public In 2024

Illustration: Dom Guzman

11 months ago

68

11 months ago

68